A German private pension plan works on the same principles than any other pension plan you can purchase in the world, i.e. the policy holder agrees to transfer a certain savings-amount for a certain period to the insurer, who in return guarantee to return a fixed capital payment or fixed pension, either for a pre-defined time frame or for life. On top of the guaranteed payment(s) the insurer will add a non-guaranteed amount on top, which is made up of various profit participation instruments.

Inflation

Inflation is the increase in the prices of goods and services over time and when moderate is healthy for economic activity.

Using 2015 as the base year the annual inflation rate in Germany averaged 1,786% between 2002 and 2022, yet since 1992 has been alarmingly low and therefore jointly responsible for leading the economy into another crisis, fuelled by recent events such as COVID-19 and the current war in Europe. Consequently, inflation has rocketed from 0.5% in 2020 to 6.9% in 2022 with serious impacts on the value of money and aftermaths no economist is currently able to predict.

How inflation affects Savings

Over time, inflation reduces the value of our savings as prices increase.

If exactly 10 years ago you had stashed 10,000€ in cash at home, considering Germany's very moderate average inflation rate of 1.786% per year during this period, today you would realise that not only its net worth has shrunk to 8,378€, but the prices too have increased exponentially. An item/ service available for 10,000€ then, costs 11,937€ at today's rate!

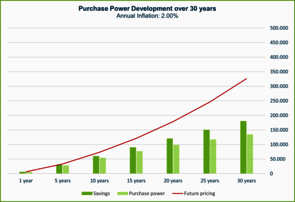

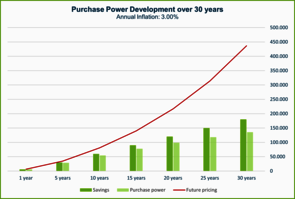

Without taking appropriate countermeasures the depreciation effect inflation has is not negligible therefore, the longer your money is not in cirrculation, the bigger your loss will be, demonstrated in the below charts.

For this reason, people prefer to park at least some of their savings in investments that at least weather inflation such a stocks, mutual funds, crypto currencies or private pension plans. Latter the more classic approach but still well accepted as not only do the insurers provide guaranteed interest-rates but offer integrated financial investment benefits with assurance that in a worst-case their clients' money will be returned wholly or at least partially.

Optional Add-on Benefits

Dynamic Premium

Having this optional benefit implemented the savings rate increases automatically on an annual basis and based on a pre-agreed percentage, usually ranging between 1% - 10%. Having to included this benefits from inception does however not imply the increase is permanent, hence it is possible to opt-out at renewal, bearing in mind that doing so on two subsequent years it will be removed for good.

This option is one we strongly to level adverse effects of inflation, thus to compensate future loss of purchasing power.

Example:

A long-term pension plan is to return the beneficiary 200,000€ capital after 30 years.

Considering however that with an average annual inflation of just 2.00% these 200k Euros today are worth just 110,414€ in 30 years, one must also calculate for the fact that to achieve the same purchase power in 30 years an actual capital payment of 362k Euro is required.

Disability Pension

An insurance designed to return an immediate pension should the insured be deemed as medically unable to work for a longer period, minimum 6 months in Germany.

The amount paid by the insurer is either in form of a predetermined monthly pension, or annual payments that are based on a percentage of all contractually due monthly savings.

Long-term Nursing Care Pension

Available only in conjunction with the Disability Pension benefit, this insurance benefit returns a life-long monthly pension to cushion the additional costs long-term nursing care entails.

Premium Waiver

A rider that states the insurance company waives all future premiums/ savings should the policyholder become unable to work due to critical illness or serious injury, and provided that the incapacity is not only medically certified but meets German legal requirements too.

Surviving Dependants Provisions

An optional benefit that returns capital and/or an immediate pension in the unfortunate event that of the policy holder's, or their nominated dependant’s, demise during the savings phase. The capital then due is either predetermined (a fixed amount) or the total amount of all monthly savings, meaning those due from inception to date of pension and regardless of whether these have been paid or not.

Alternatively, it is possible to choose an immediate monthly pension along with a capital payment consisting of all due monthly savings totalled.